Welcome to our Bullrun Finances review regarding the website at bullrunfinances.com.

Did they scam you? Let us know by commenting below.

Bullrunfinances.com, registered through OwnRegistrar, Inc. on January 17, 2023, with a domain expiration set for January 18, 2025, is a relatively new entrant in the online finance space. Updated last on January 8, 2024, the domain’s status is currently marked as “clientTransferProhibited,” suggesting restrictions on its transferability. It employs name servers under smarttech379.com, indicating a possible association with this entity for its internet infrastructure needs. The registrant details list Michael Agala of KDBPLC, based in Dallas, New York, as the point of contact.

Hosted by Namecheap, Inc., bullrunfinances.com’s server is in Los Angeles, United States, tied to the AS22612 NAMECHEAP-NET autonomous system. Despite its establishment, the domain’s presence online is minimal, with a Semrush Authority Score and Domain Rank both at zero, indicating it either lacks significant content or has yet to achieve notable traction in search engine rankings. Organic and paid search traffic metrics are nonexistent, alongside a complete absence of SERP features and keyword data. This could reflect the site’s nascent stage or struggle to establish a footprint in the highly competitive finance domain.

Moreover, the site’s backlink profile is meager, comprising only four nofollow links from three referring domains, all of which are directories, suggesting minimal external references or endorsements. The lack of substantial backlinks and the absence of an organic search presence highlight the challenges bullrunfinances.com faces in building visibility and authority online.

Bullrunfinances.com Review

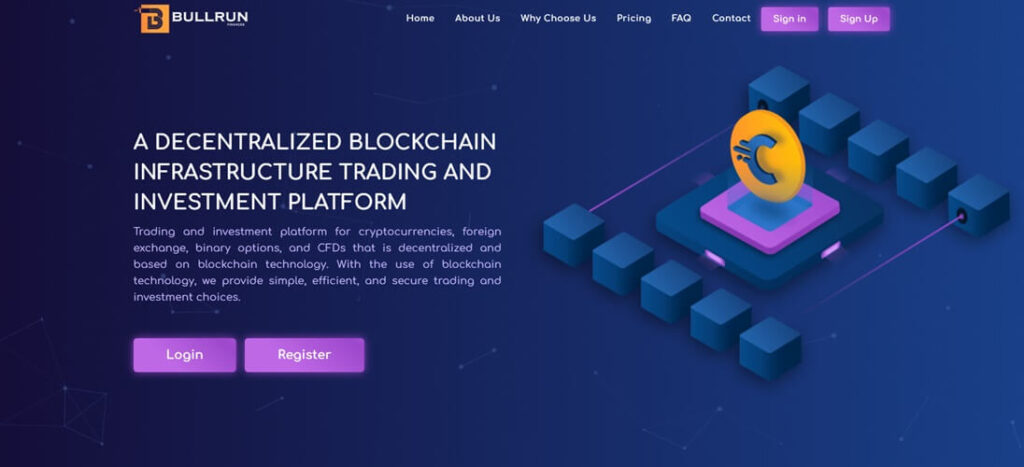

Bullrunfinances.com presents itself as a sophisticated blockchain platform that caters to various financial activities, including payments, loans, and crowdfunding. It particularly focuses on trading and investment opportunities in cryptocurrency, foreign exchange, binary options, and CFDs. The platform purports to be a decentralized platform leveraging blockchain technology to offer secure, efficient, risk-managed trading and investment options. The platform claims to be fully registered and compliant with the necessary authorities, though specific regulatory bodies or registration numbers are conspicuously absent from the provided content.

The site outlines various services and features such as a cryptocurrency converter, detailed descriptions of investment packages (Bronze, Silver, Gold), and security measures, including 2FA (Two-Factor Authentication). The investment tiers start from a minimum deposit of $3,000 for the Bronze package and extend to an unlimited maximum deposit for the Gold package, each promising varying risk management, account management, and contract durations.

The site’s contact information includes an email address (support@bullrunfinances.com) for support inquiries. A social media presence is suggested, with links to Facebook and Instagram. The website’s content claims a legal incorporation in the United Kingdom yet fails to provide any supporting evidence, such as a company number or office address, that could be used for verification.

The detailed description and promises of high returns on investment cast Bullrunfinances.com as an ambitious platform aiming to capture a broad spectrum of financial services within the digital and fiat currency spaces. The emphasis on security, professional trading, and investment strategies is designed to build trust and credibility. However, the absence of specific regulatory information and high minimum investment thresholds might raise questions about its accessibility and transparency.

Red Flags

- Lack of Specific Regulatory Information: The claim of being a “fully registered online investing platform” is not backed by any concrete regulatory body or registration number. This absence is a significant red flag since legitimate financial platforms typically provide detailed regulatory information to establish their legitimacy.

- High Minimum Deposit Requirements: The investment packages require a substantial minimum deposit starting at $3,000, which is quite high for novice investors or individuals cautious about new platforms. This could be a strategy to encourage users to make substantial initial commitments.

- Vague Contact Information: Although an email address and social media links are provided, there is no physical address or phone number for direct contact. Such vagueness can be a tactic to avoid scrutiny or direct accountability.

- Promises of High Returns: While not uncommon in the industry, the promise of “stable, risk-free long-term gains” should be approached with caution, especially when combined with the lack of detailed company information and regulatory oversight.

In conclusion, while Bullrunfinances.com positions itself as a comprehensive platform for various financial services related to digital and fiat currencies, the lack of transparent regulatory information, high investment entry barriers, and vague contact details serve as significant red flags.

Bullrun Finances’ Social Media

The social media profiles of Lea Thompson on Facebook and Bullrunfinances on Instagram provide insights into Bullrunfinances.com’s operational and promotional strategies.

Lea Thompson is introduced as the CEO and Founder of Bullrunfinances. She has academic credentials from the University of Oxford and Harvard University and resides in Orlando, Florida. The profile emphasizes Thompson’s role in cryptocurrency, mixing motivational content with personal achievements attributed to cryptocurrency investments.

Thompson’s Facebook posts include success stories of individuals allegedly benefiting from Bullrunfinances’ trading platform. These testimonials cover significant financial milestones such as purchasing stores and cars and completing projects, purportedly as direct results of investing with Bullrunfinances. The narrative consistently portrays cryptocurrency trading as a life-changing opportunity, underscoring the transformative power of engaging with Bullrunfinances’ services.

Bullrunfinances’ Instagram profile claims a substantial following and positions the platform as an official entity in the cryptocurrency space. It highlights services such as portfolio management and real-time trading/investment and mentions systematic/robotic and copy trading. Despite the significant follower count, the content is limited, suggesting a focus on projecting a reputable image rather than providing substantial engagement or value through posts.

Red Flags

- Lack of Detailed Information: Neither profile provides concrete evidence of regulatory compliance, specific investment strategies, or risk management practices.

- Success Story Reliance: Heavy reliance on testimonials without verifiable data or broader user reviews might concern critical investors seeking transparency and empirical success rates.

Bullrunfinances.com Reviews

Information from a Google search indicates that Bullrunfinances.com is part of a network of websites hosted under the domain smarttech379.com, a detail that ties the platform to a broader digital infrastructure. BuiltWith Trends data reveals that Bullrunfinances.com and other websites utilize CoinStats, a tool for the cryptocurrency market and portfolio tracking. This connection is noted within Club de Paris countries and the broader Organisation for Economic Co-operation and Development (OECD) nations, indicating a geographic spread of the platform’s reach or influence.

The index page of smarttech379.com lists multiple domains, including bullrunfinances.com, highlighting it among various other financial, trading, and cryptocurrency-focused websites. Bullrunfinances.com’s presence in such a lineup suggests its involvement in the broader landscape of online financial services, possibly sharing technology, tools, or operational practices with these associated sites. The list of sites with names implying a focus on finance, investment, and cryptocurrency underlines a collective approach to offering digital financial solutions.

Potential Concerns

- Shared Hosting Environment: The shared nature of the hosting environment could raise questions about bullrunfinances.com’s individual security, uniqueness, and operational integrity within a crowded digital space.

- Variety of Associated Sites: The diversity and number of sites within the smarttech379.com domain may necessitate further investigation into their reputations, operational histories, and potential interconnected risks or benefits to users.

Complaints We Received About Bullrun Finances

On April 6, 2024, we received the following complaint from a person who reported being scammed for over $14K:

I had been following her on Telegram for about six months. She kept posting customer comments about how they were withdrawing from her platform and how successful they had become. Then, when I messaged her, she told me the starting amount was 1000 in TETHER, so I invested as I was convinced. A couple of days later, she was updating me about how my profit had gone up, and she sent me the website of Bullrunfinances.com. The website looked legitimate and showed “real-time” how much I had profited. Seeing that, I got excited and heard about her special Easter offer. I invested around AUD 8000, after which she claimed I would receive back $140,000 within five days after Easter. It sounded unbelievable, but I was desperate, and nothing else worked for me, so I thought I’d go for it. Five days after Easter, I asked for my profits back, and she started claiming that I was making massive progress and needed to pay an extra $4850 in TETHER to purchase a bot for safety. That’s when I came across this website, saw precisely the steps I’d been through, and realized how badly I’d been scammed.

Discuss this complaint at ScamCrypto.net.

On June 11, 2024, we received another complaint:

A woman named Steph Taylor scammed me from bullrunfinances.com. She said she could help me get into investing in Bitcoin and wanted me to invest $3,000. I deposited $100, and then she disappeared, and the site no longer works.

On July 8, 2024, we received the following complaint:

I was inspired by a WhatsApp person who wanted me to invest 3000K. I did not go into it with huge expectations and only deposited $100. I was pressured to buy more but never did. Now I’m lost and can’t get to the website.

Bullrunfinances Review Conclusion

Our comprehensive review of Bullrun Finances and its associated social media presence paints a complex picture of a platform that, on the surface, promises significant opportunities in cryptocurrency and finance. However, beneath the glossy exterior of high returns and transformative financial success stories, several red flags emerge that prospective investors should not ignore.

The absence of detailed regulatory information and the high minimum investment requirements set a concerning backdrop for Bullrunfinances.com. These elements, coupled with vague contact details and an over-reliance on success stories, might indicate a platform that operates more on promises than transparent and verifiable achievements. While appealing, the platform’s claim to be a decentralized and secure blockchain infrastructure lacks the substantiation typically found with more established financial platforms.

Furthermore, the connection to a broader network of financial websites under smarttech379.com suggests a shared operational model that raises questions about the distinctiveness and integrity of Bullrunfinances.com’s services.

The personal testimonies on Lea Thompson’s Facebook profile and the significant following on Instagram provide a veneer of legitimacy and success. Still, they fail to offer the concrete evidence of compliance, strategy, and risk management that savvy investors seek. Without the backing of empirical data or broader user reviews, these success stories’ emotional appeal may target those hopeful for a quick financial turnaround, potentially leading them into situations that are too good to be true.

Firsthand accounts of individuals who claim to have been scammed, detailing processes and promises that mirror classic signs of investment fraud, add a layer of concern. While such testimonials are individual experiences, they contribute to a cautionary narrative about the risks associated with investing in platforms that lack transparency and regulatory oversight.

The Bottom Line Regarding Bullrun Finances

While the allure of high returns and financial freedom is undeniable, the review of Bullrun Finances underlines the importance of due diligence and a critical approach to investment opportunities.

The combination of regulatory ambiguity, high entry barriers, promotional strategies reliant on unverifiable success stories, and alarming personal accounts of scams all serve as stark reminders that in the high-stakes world of online investing, not all that glitters is gold.

Potential investors should approach Bullrunfinances.com with caution and skepticism, demanding transparency and verifiable proof of legitimacy.

The dream of financial independence through cryptocurrency and online trading should not eclipse the need for safety, security, and accountability in investing.

Do not lose hope if you have lost significant money to online scams. We can help you recover your funds!

When you comment, your name, comment, and the timestamp will be public. We also store this data, which may be used for research or content creation in accordance with our Privacy Policy. By commenting, you consent to these terms.