Welcome to our LoyalLending.com review, in which we investigate Loyal Lending reviews.

Did they scam you? Let us know by commenting below.

LoyalLending.com was registered on October 3, 2020, through GoDaddy, updated on October 5, 2023, and is set to expire on October 4, 2024. Cloudflare and Domains By Proxy protect it.

Loyal Lending is based in Livonia, Michigan, United States. According to SimilarWeb, they have 51-200 employees. In November 2023, they received 455 visits from the United States and Canada.

LoyalLending.com has a SEMrush Authority Score of 10% with 107 backlinks from 34 referring domains.

LoyalLending.com Review

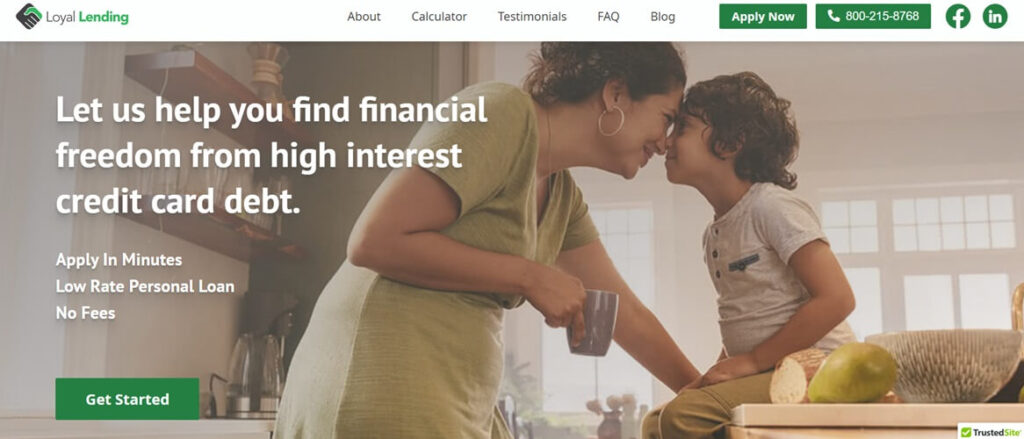

Before looking at Loyal Lending reviews, let’s review their website.

Loyal Lending appears to be a financial services company focused on debt consolidation loans, particularly targeting individuals struggling with high-interest credit card debt. The company’s approach is centered around offering low-interest rate consolidation loans, aimed at simplifying clients’ debt repayment processes and helping them achieve financial stability.

Loyal Lending’s primary offering is debt consolidation loans, which they present as a solution for managing and reducing high-interest credit card debt. They emphasize the simplicity and potential cost savings of their loans, suggesting these can replace multiple debt payments with a single, more manageable monthly payment. The service is particularly targeted at individuals feeling overwhelmed by multiple debts and high interest rates.

The content provided on Loyal Lending’s website includes extensive educational material aimed at individuals seeking financial advice. This ranges from tips on starting side gigs for additional income to advice on managing holiday spending and achieving financial stability. The information is presented in a way that suggests a deep understanding of the financial challenges faced by average Americans, particularly those related to debt and credit management.

Loyal Lending lists its address as 13 N Washington Street, Ypsilanti, MI 48197, and provides a contact number, 800-215-8768, for inquiries and applications. This transparency in location and contact details is usually a positive sign in assessing a company’s legitimacy.

Red Flags and Potential Concerns Regarding LoyalLending.com

- High-Pressure Tactics: The emphasis on immediate application and the sense of urgency conveyed in some of the content could be seen as a high-pressure tactic. While this isn’t necessarily indicative of a scam, it’s a common technique used in aggressive sales strategies.

- Absence of Specific Regulatory Information: While the site mentions compliance with various regulations and boasts certifications, there’s a lack of specific regulatory information, such as licensing numbers or detailed compliance measures. For a financial institution, especially one dealing with debt and loans, detailed regulatory compliance information is crucial.

- One-Size-Fits-All Solution: The website seems to heavily promote debt consolidation loans as a solution for a range of financial issues. While debt consolidation can be beneficial for some, it’s not a universal solution. The lack of information on potential risks or downsides of consolidation loans is a concern, as it might not be the best option for every individual facing debt issues.

- Generic Financial Advice: While the financial advice given is generally sound, it is quite generic. A more personalized approach or case studies could enhance the credibility of their advice.

- No Mention of Fees or Additional Costs: There’s no clear mention of any fees or additional costs associated with obtaining a loan from Loyal Lending. Transparency in pricing and fees is critical in financial services to build trust.

- No Direct Links to Regulatory Bodies: While the site mentions various affiliations and compliance with regulations, there are no direct links to these regulatory bodies or evidence of such affiliations.

Loyal Lending presents itself as a company dedicated to helping individuals with high-interest debts, offering a range of educational resources and debt consolidation services. However, the lack of detailed regulatory information and potential high-pressure tactics could be areas of concern for potential clients.

Social Media Accounts Associated with LoyalLending

Before going over the Loyal Lending reviews, we examine the social media profiles of Loyal Lending on LinkedIn and Facebook. Several observations can be made about the company and its online presence:

LoyalLending’s LinkedIn Profile

- Company Size and Industry: Loyal Lending is categorized under financial services with a company size of 11-50 employees. This positions it as a relatively small player in the industry.

- Content and Engagement: The LinkedIn profile primarily shares articles from external financial news sources such as MarketWatch. Topics covered include general economic trends, personal finance, and insights on debt management. This suggests an effort to position the company as informed and engaged with current financial issues.

- Followers and Interaction: With 9 followers, the LinkedIn presence of Loyal Lending is minimal. This low level of followers and engagement may indicate either a new or not very active presence in professional social networks.

LoyalLending’s Facebook Page

- Page Activity and Engagement: The Facebook page, similar to LinkedIn, predominantly shares articles from MarketWatch, focused on various financial topics. This consistent approach across platforms demonstrates an effort to provide educational content to their audience.

- Page Likes and Followers: The page has a modest following with 6 likes and 9 followers. This small social media footprint suggests either a recent entry into social media marketing or a limited engagement strategy.

- Company Information: The page confirms the focus on financial freedom from high-interest credit card debt, aligning with the messaging on the company’s website.

Critical Observations

- Consistent Messaging: Both platforms reflect Loyal Lending’s focus on debt consolidation and financial freedom from credit card debt. The consistency in messaging across platforms reinforces the company’s brand and service focus.

- Educational Approach: The company seems to take an educational approach in its social media content, sharing articles related to financial matters, which could be beneficial for clients seeking information.

- Low Social Media Engagement: The limited followers and interaction on both LinkedIn and Facebook might indicate that either Loyal Lending is relatively new to social media or has not yet invested heavily in this area of marketing and engagement.

Loyal Lending’s social media presence, characterized by a focus on financial education and a small but consistent engagement pattern, complements the information on its website. While the low level of engagement and followers might raise questions about the company’s reach or impact on social media, it does not necessarily indicate any red flags regarding the legitimacy or operations of the company.

Loyal Lending Reviews

After thoroughly reviewing the provided information about Loyal Lending, a clear image emerges that raises several concerns about the legitimacy and reliability of the service.

The website analysis from EvenInsight.com and ScamAdviser both point towards questionable aspects of Loyal Lending’s online presence. EvenInsight.com has tagged Myloyallending.com, which redirects to Loyal Lending, as a suspicious site with a notably low safety score. This suspicion arises from the site being recently created and not well-known, alongside its engaging in practices like external redirections and presenting a blank homepage. Similarly, ScamAdviser’s moderate trust score for loyallending.com is tempered by concerns about the anonymity of the site’s ownership and its association with other low-rated websites despite the domain being relatively old.

Loyal Lending’s social media footprint, particularly on LinkedIn and Facebook, does little to dispel these concerns. With only a handful of followers and limited engagement, their LinkedIn page indicates a minimal online impact. The Facebook page too, with just six likes and nine followers, primarily shares links to MarketWatch articles and lacks substantial, original content.

User experiences shared on Reddit further compound the skepticism surrounding Loyal Lending. Several users recount receiving unsolicited mail offering attractive debt consolidation deals that, upon further engagement, transform into high-interest loan offers. This bait-and-switch tactic is a common red flag. One user emphatically branded the operation a scam, noting a barrage of calls from associated companies offering poor financial solutions.

Another user corroborated this sentiment by pointing out Loyal Lending’s F rating on the Better Business Bureau (BBB). This rating is further supported by the BBB’s own investigations, which highlight the company’s lack of physical verifiability and connections to a call center used by numerous debt relief agencies.

Loyal Lending Reviews Conclusion

The analysis of Loyal Lending, based on various sources, including user experiences, website reviews, and social media presence, points to several red flags that raise concerns about the company’s credibility and operational transparency.

Firstly, the Better Business Bureau’s (BBB) inquiry into Loyal Lending revealed significant issues. The lack of response to BBB’s request for basic business information, such as the nature of the business (virtual or location-based), registration status, and licensing details, is a major red flag. Additionally, the fact that Loyal Lending is not a registered business name in the State of Michigan, coupled with the non-deliverable mail to the provided PO Box address, casts further doubt on the legitimacy of the company.

The domain registration details for loyallending.com, hidden using privacy services, and the inconsistency in the website’s “last update” date versus the actual domain registration date, add to the concerns. These factors suggest a lack of transparency and possible attempts to obscure the true nature of the business.

Moreover, user experiences shared on Reddit depict a troubling picture of Loyal Lending’s operations. Reports of unsolicited mailings with attractive loan offers, which upon further engagement turned out to be high-interest loans or debt management services, are indicative of deceptive marketing practices. This bait-and-switch approach, along with complaints of persistent calls and texts from associated companies, aligns with typical high-pressure scam tactics.

Loyal Lending’s social media presence, characterized by low engagement and minimal original content, does not help in establishing credibility. The LinkedIn and Facebook pages, with their limited following and engagement, fail to provide a robust or convincing online presence.

Loyal Lending Reviews: Bottom Line

Considering these findings, potential clients are advised to exercise extreme caution when dealing with Loyal Lending. The lack of clear, verifiable business information, along with the reported high-pressure tactics and misleading marketing, suggests that this company may not be a trustworthy financial service provider. It’s crucial for individuals to thoroughly research and verify the credentials and reputation of any financial service provider before engaging with them, especially when it involves sensitive financial matters like debt consolidation.

If you have lost a significant amount of money to online scams, do not lose hope. We can help you recover your funds!