On March 11, 2023 we received a complaint from a person who claims losing $1,500 to a LightStream Loans scam.

The person applied online for a personal loan and was contacted by a company claiming to be LightStream Loans. The person was approved for a loan but was told they had to pay for insurance to receive it. The company deposited the insurance money into the person’s bank account and instructed them to withdraw it and send it back through Bitcoin. The person agreed and did this twice, totaling $1500.

The company kept asking for more money and the person eventually realized that the so-called insurance money was actually chargebacks from previous payments they had made. When the person confronted the company, they were told they needed to pay $450 for service and transfer charges to receive their loan.

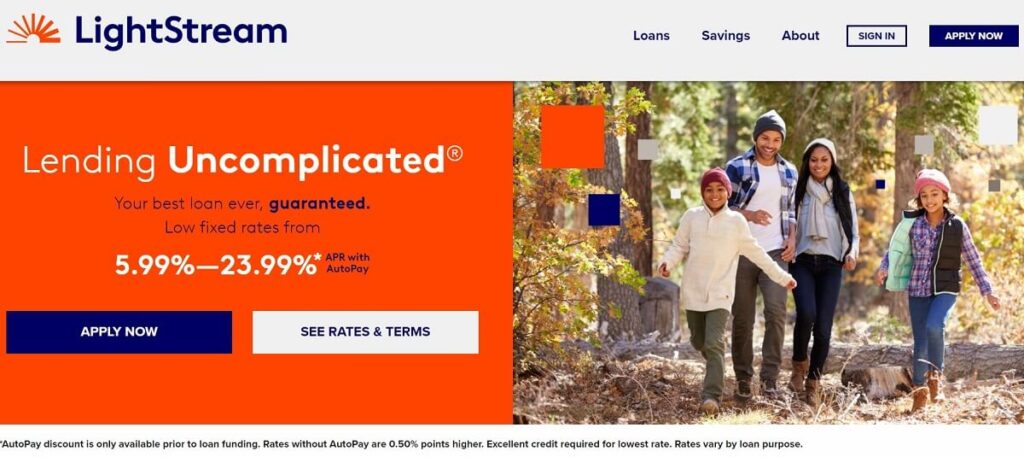

LightStream offers loans for a variety of purposes, including auto, home improvement, debt consolidation, medical bills, weddings, and more. The loans have low fixed rates starting at 5.99% APR with AutoPay, and are only available to customers with good-to-excellent credit. LightStream has won several awards and customers praise the company for its quick and easy loan application process and great rates. The LightStream app allows customers to manage their account, check payment due dates, and make payments.

The domain lightstream.com was registered on June 23, 1997 through CSC Corporate Domains, Inc. for 26 years, but was updated on June 18, 2022. It is hosted by Bell Canada.

The Registrant Contact is SunTrust Domain Administrator of SunTrust Bank. Address: 303 Peachtree Center Avenue, Atlanta GA 30303 USA. Phone: 303-813-7522. Email: digitalgovernance@suntrust.com.

Based on SimilarWeb, they are ranked 65,589 globally and 12,158 in the USA. (342 in the Finance > Banking Credit and Lending in United States.) In February 2023, they received almost 710,000 visitors, almost exclusively from the United States.

Their Semrush Authority Score is 49% which is high and it has 770K backlinks from 6.2K referring domains.

So LightStream is most likely not a scam, still let’s see what their clients have to say.

Light Stream Reviews

On TrustPilot they are ranked 1.8/5 stars (poor) based on 54 reviews. Many of the reviews are negative, with customers complaining of poor customer service, scams, and denial of loans even with excellent credit scores. Some customers also had issues with the company trying to auto-debit payments even after the loan was paid in full or not receiving loan proceeds after being approved. There are also concerns about the company’s business model, with some feeling that they target people with poor credit scores to take advantage of them.

In the last three years, there have been 41 total complaints filed with the Better Business Bureau (BBB). The business has responded to all complaints, with a response rate of 100%. Complaints include issues with product/service, problems with billing/collection, and suspicious communication attempts. LightStream states that it will never send unsolicited emails, text messages or letters asking clients to provide personal or account information.

A LightStream customer reported wanting to verify if a loan offer was a scam. After researching, they discovered that the company was legitimate but the phone number used to contact them was hacked.

The customer was almost scammed when the loan provider asked for their mobile deposit username and password. The customer put a fraud alert on their bank account and locked their credit file. They advised others to use LightStream’s safe deposit option if unsure about a loan. As LightStream doesn’t have a phone number, the best way to contact them is through their help desk.

ScamPulse received several reports about Light Stream. People who have filed complaints report that Light Stream asked for bank login information and deposits in order to receive a loan. After these deposits are made, the company would ask for more money to “boost credit scores” and to purchase gift cards.

Victims who complied with the requests and purchased the gift cards eventually found out that the temporary funds deposited were fraudulent and not from Light Stream, leading to further complications. Other complaints include recurring charges from unknown sources, possible money laundering, and being threatened with legal action if they didn’t comply with Light Stream’s demands.

Ryan Booker, a 26-year-old from Louisville, fell for a scam after being denied loans and needing to pay off medical expenses and bills. He was approached via email and offered an $8,000 loan from LightStream A Division of SunTrust Bank.

He then proceeded to pay $450 in wire transfer fees, followed by $350 on Google play cards. He realised too late that the letter he received was fake, and LightStream and SunTrustBank confirmed it was. The scammers asked for Google play cards because they could buy anything or sell off the numbers on the cards. Booker stated that he would never see the money again and that he learned a valuable lesson: “Ask questions” and “trust your gut.”

LightStream Scams – Bottom Line

LightStream is a company that provides personal loans to consumers with good credit. They offer loans for various purposes, including home improvement, auto financing, and debt consolidation. LightStream is a division of SunTrust Bank, and their loans are funded by SunTrust Bank.

LightStream Loans is a legitimate company that offers personal loans to customers with good-to-excellent credit scores. While the company has received positive feedback for its easy application process, low fixed rates, and great customer service, some customers have reported negative experiences. There have been reports of LightStream scams where scammers ask for insurance payments to be made through Bitcoin.

There have also been instances where customers have fallen victim to scams and lost money due to fraudsters posing as LightStream representatives.

To protect oneself from LightStream scams, it is important to be cautious of unsolicited emails, text messages, or letters that ask for personal or account information.

It is important to be cautious of scams claiming to be affiliated with LightStream or SunTrust Bank, as scammers may attempt to deposit fraudulent checks and ask for gift cards as a deposit, which is not a legitimate practice. If you have any concerns or suspicions, it is recommended that you contact your bank and report the incident.

To recognize and avoid personal loan scams,

- research the lender thoroughly

- avoid paying money upfront for a loan

- question lenders that guarantee approval

- pay attention to how the lender reaches out to you

If you have lost a significant amount of money to online scams, do not lose hope. We can help you recover your funds!