In an era where online financial platforms are booming, it’s crucial to distinguish between legitimate investment opportunities and potential scams. One such platform that has raised eyebrows is One Swap Fx (Oneswapfx.com).

This article aims to shed light on what One Swap Fx is about, highlight some red flags to be aware of, offer tips on how to protect yourself and provide insights on how to protect yourself from such dubious websites.

One Swap Fx Overview

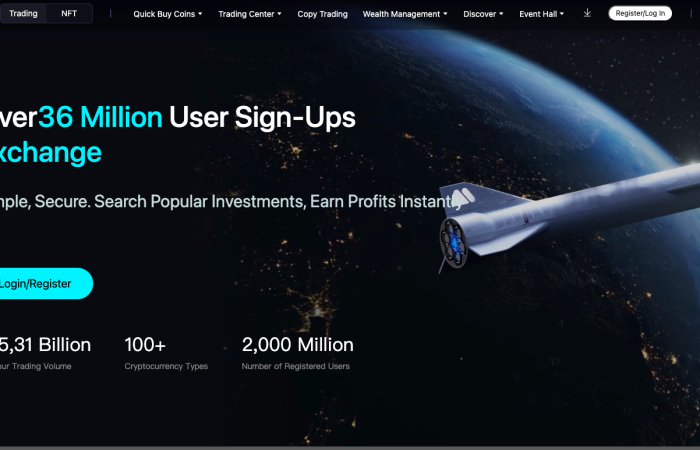

One Swap Fx is a website that markets itself as an online investment platform, targeting individuals looking to enhance their financial portfolios. It positions itself as a one-stop destination for various financial services, with a particular focus on the following aspects:

- Trading: One Swap Fx promotes trading services across various financial markets, including stocks, currencies, commodities, and indices. It suggests that users can engage in speculative trading to potentially profit from market fluctuations.

- Asset Management: The platform claims to offer professional asset management services, allowing users to entrust their investments to experienced professionals. This service is often marketed as a hands-off approach for investors who prefer experts to manage their funds.

- Cryptocurrency Investments: One Swap Fx also delves into the cryptocurrency space, asserting that it provides opportunities for users to invest in cryptocurrencies like Bitcoin, Ethereum, and other digital assets. Cryptocurrencies have gained popularity as alternative investments, and the platform appears to tap into this trend.

While One Swap Fx presents itself as a potential avenue for financial growth, it’s essential to consider its promises and perils.

One Swap Fx Promises

- Profit Potential: One Swap Fx suggests that users can achieve substantial profits through their services, including trading and cryptocurrency investments. The allure of high returns often attracts investors.

- Convenience: The platform may appeal to individuals seeking a convenient way to access online financial markets and asset management services.

- Diverse Offerings: By offering various financial services, it aims to cater to different investment preferences and strategies.

One Swap Fx Perils

- Lack of Transparency: One Swap Fx’s lack of transparency regarding ownership and operational details raises concerns about its legitimacy. Investors should be careful when dealing with platforms that do not readily disclose such information.

- Unrealistic Promises: The platform’s claims of guaranteed high returns can be a red flag. Investments inherently carry risks; any investment promising low risk and high returns should be viewed skeptically.

- Regulatory Compliance: The website’s regulatory compliance and registration status remain unclear. This lack of regulatory oversight can leave investors without recourse in case of disputes or issues.

- Mixed Customer Feedback: Customer reviews and feedback about One Swap Fx are mixed, with some users reporting positive experiences while the majority of the others highlight difficulties with withdrawals and customer support.

One Swap Fx Red Flags

- Hidden Ownership: The website conceals information about its owners or operators. Lack of transparency regarding the individuals or entities behind the platform can be a significant red flag, making it difficult to verify the legitimacy of the business.

- Unrealistic Promises: The website claims guaranteed high returns with little to no risk. Promises of exceptionally high profits with minimal effort or risk are classic red flags often associated with investment scams.

- Limited Contact Information: A legitimate website should provide clear and accessible contact information, including a physical address and customer support details. Inadequate or hard-to-find contact information is a red flag.

- Sudden Urgency: The website employs high-pressure sales tactics, urging visitors to act quickly without sufficient time for due diligence. Urgency can be a red flag used to manipulate potential investors.

- Incomplete or Inconsistent Information: Inconsistencies or incomplete information on the website, such as typos, broken links, or contradictory statements, can raise suspicions about its professionalism and legitimacy.

- Limited Online Presence: A lack of a substantial online presence, including social media profiles, reviews, or articles from reputable sources, can be a red flag. Established and reputable businesses usually have a traceable online footprint.

- No Independent Verification: If the website’s claims cannot be independently verified through reputable financial or regulatory sources, it should be considered a red flag. Reliable investment platforms typically provide verifiable information.

- Unsolicited Communication: Receiving unsolicited emails or messages promoting the platform can be a red flag. Be cautious of any investment opportunity that approaches you without your prior consent.

How to protect yourself from platforms such as One Swap Fx?

Protecting yourself from potential scams and fraudulent websites, especially in the realm of online investments, is crucial. Here are several steps and strategies to help you safeguard your financial well-being:

Do Thorough Research & Check for Regulatory Compliance

Research the website or platform extensively. Look for information about its history, ownership, and operational details. Verify the website’s credibility through trusted sources.

Ensure the platform is registered with the appropriate regulatory authorities in your region. This registration indicates that the platform adheres to certain regulatory standards and oversight.

Beware of Unrealistic Promises and Look for Transparency

Be cautious of any investment promising guaranteed high returns with little or no risk. Investments inherently carry risks and offers that often seem too good to be true.

Legitimate businesses typically provide transparent information about their owners and operators. Be wary of platforms that hide their ownership details.

Verify Contact Information and Check for Red Flags

Ensure the platform provides clear and easily accessible contact information, including a physical address and customer support details.

Attention specific red flags like hidden ownership, limited regulatory compliance, and high-pressure sales tactics. These indicators can signal potential scams.

Avoid Unsolicited Offers and Diversify Your Investments

Avoid unsolicited emails or messages promoting investment opportunities. Reputable businesses typically do not engage in cold outreach.

Avoid putting all your funds into a single investment or platform. Diversify your investments across various assets and platforms to mitigate risks.

Seek Professional Advice and Check for Independent Verification

If you have doubts or uncertainties about an investment opportunity, consider seeking advice from a qualified financial advisor. They can provide personalized guidance based on your financial goals and risk tolerance.

Verify the information provided by the platform through independent and reputable financial sources. Reliable investment platforms have verifiable data.

Be Skeptical of Urgency and Educate Yourself

Beware of investment opportunities that pressure you to make quick decisions. Take your time to conduct due diligence.

Invest in your financial education. Understanding the basics of investments, risk management, and common investment scams will empower you to make informed decisions.

Report Suspicious Activity

If you suspect you’ve encountered a fraudulent website or investment scheme, report it to relevant authorities and consumer protection agencies. Your report can help protect others from falling victim to the same scam.

Stay informed about the latest scams and frauds in the financial sector

Awareness of common tactics scammers use can help you recognize and avoid potential threats.

Use Trusted Platforms

Use well-known and trusted platforms or financial institutions for investments and transactions.

One Swap Fx Review Conclusion

Protecting yourself from potential scams and fraudulent websites like One Swap Fx requires a combination of vigilance, research, and informed decision-making. Ultimately, your financial security is in your hands.

By following these steps and remaining cautious, you can significantly reduce the likelihood of falling prey to fraudulent schemes and make informed decisions to protect your hard-earned money. Remember that if an investment opportunity appears too good to be true, it likely is, and it’s better to err on the side of caution.

If you are a victim of online scams, please let us know by commenting below, and if you have lost a significant amount of money, do not lose hope. We can help you recover your funds!