Welcome to our Chase Bank Scams Warning.

Recently, we received the following complaint from a Chicago, USA person:

Chase Bank committed fraud against me for transactions that were made in Florida, while I live in Chicago. The transactions amounted to $2000, but Chase doesn’t want to refund my money.

It sounds like they have experienced fraud on their Chase bank account. They should contact Chase Bank customer support as a first step and explain the situation. They may be able to investigate the fraudulent transactions and refund the money.

Next, they should file a fraud report with Chase Bank and provide any documentation or evidence related to the fraudulent transactions.

Finally, they should contact the police in Chicago and Florida and file a report with them, as well as possibly contact an investigation company specializing in banking or fraud cases for legal advice and assistance.

In the rest of this article, we discuss Chase Bank scams.

Types of Chase Bank Scams

Phishing Chase Bank Scams

These scams typically involve fraudulent emails or text messages that appear to be from Chase Bank, asking customers to provide personal or financial information.

The scammers will then use this information to access the customer’s account and steal money.

Smishing Chase Bank Scams

Similar to phishing scams, smishing scams involve fraudulent text messages that appear to be from Chase Bank, asking customers to provide personal or financial information.

These scams often include a link to a fake Chase Bank website, where customers are asked to enter their information.

Phishing and Smishing scams are fraudulent attempts to steal sensitive information from individuals but differ in delivery method.

Phishing scams are typically carried out via email or a fake website designed to look like a legitimate one.

The scammers send an email that appears to be from a reputable source, such as a bank or a company like Chase Bank. They ask the recipient to provide personal or financial information, such as login credentials or credit card details.

The fake website will often have a similar design and layout as the legitimate one to trick the victim into providing the information.

On the other hand, Smishing scams are carried out via text messages or SMS.

The scammers send a text message that appears to be from a reputable source, like a bank or a company, and they ask the recipient to provide personal or financial information.

The message may contain a link to a fake website, where the victim is asked to enter their information, or the message may contain a phone number to call and provide the information.

In both cases, the goal is to steal personal or financial information from the victim, but the delivery method differs.

Malware Chase Bank Scams

These scams involve using malicious software (malware) to access a customer’s computer or mobile device.

The malware may be downloaded onto the device via a phishing or smishing scam and can then be used to steal sensitive information.

Imposter Chase Bank Scams

Imposter scams involve fraudsters posing as Chase Bank employees, either over the phone or via email.

They may ask for personal or financial information, claim a problem with the customer’s account, and ask them to pay to resolve it.

Investment Chase Bank Scams

Investment scams involve fraudsters posing as Chase Bank representatives and offering customers high-return investment opportunities.

The scammers may ask for large sums of money upfront, promising to invest it for the customer and generate a significant profit.

However, there is no investment opportunity in reality, and the scammers take the customer’s money and disappear.

It’s important to note that these are just a few examples of Chase Bank scams and that scammers are constantly coming up with new tactics to try and defraud customers.

It’s essential to be vigilant and cautious when dealing with unsolicited communications or personal information requests.

How to Avoid Chase Bank Scams

Here are some tips on how to avoid Chase Bank scams:

Use Strong Passwords and Two-Factor Authentication

Use a unique and complex password for your Chase Bank account, and enable two-factor authentication to add an extra layer of security.

This will prevent hackers from quickly gaining access to your account.

Be Careful with Email and Text Messages

Be wary of any email or text message asking you to provide personal information or click a link.

Always double-check the sender’s email address or phone number, and be cautious of unsolicited messages.

Keep Your Computer and Phone Secure

Install reputable anti-virus and anti-malware software on your computer and phone to prevent hackers from accessing your device.

Keep your software and operating systems up to date with the latest security updates.

Check Your Account Regularly

Regularly monitor your Chase Bank account for any suspicious activity.

Report any unauthorized transactions or activity to Chase Bank immediately.

Use Common Sense

It probably is if an offer or opportunity seems too good to be true.

Always be cautious of any unexpected or unsolicited communication, and never provide personal information unless you are sure it is a legitimate request.

Following these tips can help protect yourself from Chase Bank scams and keep your financial information safe.

What to Do if You’ve Been Scammed

If you’ve been scammed, here are some steps you should take:

Contact Chase Bank Customer Support

Once you realize you’ve been scammed, contact Chase Bank customer support as a first step.

Explain the situation to them, and they may be able to investigate the fraudulent transactions and refund the money.

File a Fraud Report with Chase Bank

After contacting customer support, file a fraud report with Chase Bank.

Provide any documentation or evidence you have related to the fraudulent transactions.

File a Report with the Police

Contact the police in both your local area and where the scam occurred.

File a report with them and provide any evidence or documentation you have.

This can help in the investigation and potentially lead to the recovery of your funds.

Consider Seeking Legal Advice from a Cybersecurity Company

If you have lost significant money or are having trouble recovering your funds, consider seeking advice from an investigation company specializing in fraud cases, such as CNC Intelligence.

They can help guide you through the process and guide you regarding the steps you should take to maximize your chances of recovering your funds.

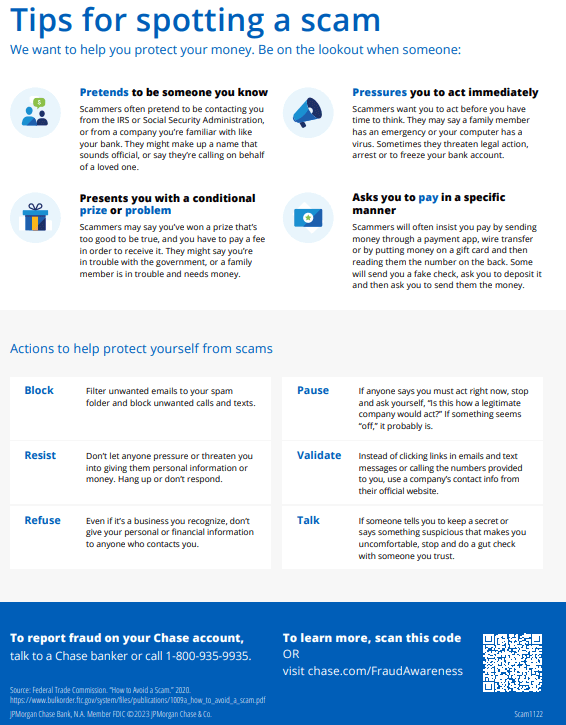

Advice from Chase.com

Here are some tips for protecting against scams from the Chase Bank website.

Tips for spotting a scam

The article provides tips on how to spot and protect oneself from scams. Some warning signs include receiving a conditional prize or being pressured to act immediately. Scammers may also pretend to be someone you know or ask you to pay in a specific manner.

The article suggests blocking unwanted calls and texts, not giving personal or financial information to anyone who contacts you, and validating information through a company’s official website.

Child Safety and Cybersecurity for online shopping

As technology becomes more common in children’s lives, teaching them about cybersecurity is essential. Parents should ensure their child locks their device when not in use, never shares passwords, and doesn’t talk to strangers online. Most devices have child safety features, which should be reviewed, and parents should educate their children about online fraudulent schemes.

Parents can also explain the difference between credit and debit cards to older children, with credit cards being safer for online shopping. Children should also be taught to recognize dangerous websites and avoid pop-up ads.

Be aware, and stay protected.

The article provides tips on protecting your money from various fraudulent activities, including identity theft, phishing, and scams. It suggests ways to stay vigilant and recognize suspicious activities such as unrecognizable transactions, unusual bank activity, and access requests.

The article also suggests easy ways to keep information secure and provides information on what to do if you suspect fraud. It highlights Chase Credit Journey, which offers free identity monitoring, including surveillance, data breach monitoring, and Social Security number tracking. The article also discusses the risk of fraud, elder financial abuse, and the importance of a financial caregiving plan.

Sign and Release Scams

Sign and Release is a scam in the auto industry. A scammer recruits an unsuspecting consumer to enter into a vehicle loan or lease, promising to make payments or pay off the account within a few months.

The consumer turns over the vehicle to the scammer and is compensated for their time and effort. Still, the scammer doesn’t make payments, and the car goes missing, leaving the consumer responsible for the lease/loan payments and negatively impacting their credit if not paid.

What is a credit card data breach?

A credit card data breach occurs when an unauthorized individual can access personal credit card data, including the card owner’s name, address, card number, expiration date, and verification code. A breach can happen accidentally or through an intentional act of theft.

To reduce the risk of a data breach, individuals should secure and update their passwords, use two-factor authentication logins, dispose of unused credit cards and personal information, know the signs of a scam, and ask their credit card provider about security measures.

In a breach, the card issuer must inform customers of the violation. Customers should review their credit card statements for unauthorized purchases and change the passwords on any associated accounts.

How to check if a website is legit

This article provides a list of tips to help determine if a website is legitimate.

It discusses the risks of online scams and phishing and suggests that users examine the URL, investigate the SSL certificate, check for poor grammar, verify the domain, look up the company’s social media presence, check the website’s privacy policy, and avoid clicking on questionable links in emails.

Help keep your money safe.

Chase offers tips to identify and avoid financial abuse, as fraud is rising, with reports increasing by over 100% in the last ten years.

Older people are especially vulnerable and continue to report higher individual dollar losses than younger adults.

The website provides warning signs, ways to prepare for the future, and resources to report fraud.

Chase also offers features to help monitor an account and helps protect information.

Security for credit cards

This article provides five tips to protect your credit cards from identity theft and fraud.

The first tip is to set a good security foundation early by choosing a secure password and PIN and turning on account alerts.

The second tip is to avoid sharing account information, including never emailing account information and never giving your social security number.

The third tip is to stay secure online by avoiding storing credit card information on a website, only shopping on secure networks, and logging out when finished.

The fourth tip is to watch for phishing, which involves fraudulent attempts to steal your account information.

The fifth and final tip is to report fraud ASAP by calling your bank immediately, double-checking receipts, never leaving receipts behind, and maintaining an updated list of your credit cards and their account numbers.

Is online banking safe?

Online banking is generally considered safe due to the array of security protocols banks implement. These security measures may include encryption, multi-factor authentication, and bank account activity monitoring and alerts.

However, customers should also practice safe online banking habits such as using strong passwords, avoiding public Wi-Fi networks, setting up alerts for bank account activity, and being vigilant for phishing scams.

A combination of robust security features and proactive customers is the most effective way to ensure online banking safety.

Precautions against fraud for students

Financial fraud is a growing problem that requires attention from everyone, but students are particularly vulnerable as they financially navigate their college journey. Common fraud examples include scholarship and financial aid scams, employment scams, overpayment and person-to-person payment scams, online marketplace scams, and scams related to federal student loan debt relief.

To help protect against these scams, students should verify who the recipient is before sending money, never offer personal or account information to someone who calls them directly, and takes a moment to think before taking action. Trusting one’s gut feeling when something seems too good to be accurate and verifying information before committing financial information or money can prevent becoming a scam victim.

Protecting yourself against the dark web

Chase Credit Journey® alerts customers when their personal information appears on the dark web. The dark web is a network of websites where people can anonymously share information, but it can also be a place for identity thieves to trade and sell personal information.

To prevent data exposure, users are advised to use unique, strong passwords and two-factor authentication. If an alert is received, Chase recommends customers change their passwords, review their credit reports, contact the Social Security Administration if their SSN was compromised, and contact their banks to file a dispute if they see any charges they do not recognize.

Identity theft: How to check for it and how it can happen

Identity theft is a common issue, with 5.9 million reports in 2021. Imposter scams and identity theft are two methods by which someone can steal personal information. Imposter scams occur when someone pretends to be someone else, such as a government agent or romantic interest, while identity theft involves using someone’s personal information, usually for financial gain. Identity theft can occur through account takeover, phishing, online shopping, and medical bills.

To protect themselves, individuals should stay aware of their bank and credit accounts and consider using credit and identity monitoring tools. Chase Credit Journey offers free credit score checks and identity theft monitoring options to help individuals prevent and recover from identity theft.

Help keep your money and personal information safe

Chase Bank provides tips to help protect against check fraud and other common scams. Scammers can use checks that are written carelessly to commit fraud and use chemicals to erase information on a check and rewrite it to their advantage.

Customers are advised to use permanent pens to fill out checks, sign them consistently, and mail them from within a post office. Customers are also advised to use the Chase Mobile app, which can help verify that the payee and check amount match what was initially written.

In addition to check fraud, Chase warns against various scams, including “Pay Yourself” scams, phishing, and investment fraud.

Customers should follow safety best practices and be cautious of communication requesting personal information or money.

What is phishing?

The page is about fraud prevention and what to do if you fall victim to phishing, a fraudulent technique criminals use to trick individuals into providing sensitive information. Phishing can be done via email, text message, or phone.

The page also gives examples of fraudulent email messages and what to do if you suspect an email is phony.

Don’t get tricked by a phishing scam.

The article warns about the risks of phishing scams affecting businesses of all sizes and industries. It provides tips on avoiding falling prey to these scams and emphasizes the importance of staying vigilant against such attacks.

Chase Bank Scams: Bottom Line

It’s essential to be aware of the various types of scams and take steps to protect yourself.

This article has outlined some of the most common Chase Bank scams and provided tips on how to avoid them.

If you fall victim to a scam, it’s essential to take action immediately by contacting Chase Bank customer support, filing a fraud report, and contacting the police.

It’s important to remember that scams and frauds constantly evolve and become more sophisticated. Scammers may use various tactics to gain your trust and steal your personal information or money. Therefore, staying informed and being cautious when dealing with unfamiliar situations online is crucial.

We encourage our readers to share this article with their friends and family to spread awareness about scams and how to avoid them.

Additionally, if you encounter any suspicious activity online, report it to us, and we will guide you on your next steps.

By working together, we can help protect ourselves and others from falling victim to scams and fraud.

If you are a victim, please let us know by commenting below.

If you have lost significant money to online scams, do not lose hope. We can help you recover your funds!